nd sales tax rate 2021

58 rows Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county. This rate includes any state county city and local sales taxes.

How Is Tax Liability Calculated Common Tax Questions Answered

Maximum tax refund cap decreases to 25sale Contracts bid prior to January 1 2021 are exempt from the rate and maximum tax increase.

. State Tax Rates. Start filing your tax return now. Before the official 2022 North Dakota income tax rates are released provisional 2022 tax rates are based on North Dakotas 2021 income tax brackets.

December 2021 5. TAX DAY NOW MAY 17th - There are -355 days left until taxes are due. Tax rates are provided by Avalara and updated monthly.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. Schedule ND-1NR line 22 to calculate their tax. The North Dakota State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Dakota State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

October 2021 5. Find 49900 - 49950 in the. 374 rows North Dakota Sales Tax.

City Tax Special Tax. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. The state sales tax rate in North Dakota is 5 but.

The tax rate for Northwood starting January 1 2021 will be 25. November 2021 5. 31 rows The state sales tax rate in North Dakota is 5000.

The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. The local sales tax rate in Selfridge North Dakota is 45 as of May 2022. Look up 2021 sales tax rates for Absaraka North Dakota and surrounding areas.

Taxpayers are residents of North Dakota and are married filing jointly. The base state sales tax rate in North Dakota is 5. ND Rates Calculator Table.

Average Sales Tax With Local. The minimum combined 2022 sales tax rate for Bismarck North Dakota is. North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Look up 2021 sales tax rates for Grand Rapids North Dakota and surrounding areas. The County sales tax rate is. Look up 2021 sales tax rates for Lignite North Dakota and surrounding areas.

No states saw ranking changes of more than one place since July. 2022 North Dakota Sales Tax Table. With local taxes the.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. 2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Marmarth ND.

The Bismarck sales tax rate is. This is the total of state county and city sales tax rates. North Dakota tax forms are sourced from the North Dakota income tax forms page and are.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax. Marmarth ND Sales Tax Rate. If your ND taxable.

The North Dakota sales tax rate is currently. Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen. Find your North Dakota combined state and local tax rate.

The 2022 state personal income tax brackets are updated from the North Dakota and Tax Foundation data. North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Exemptions to the North Dakota sales tax will vary by state.

Their North Dakota taxable income is 49935. Tax rates are provided by Avalara and updated monthly. Over the past year there have been eighteen local sales tax rate changes in North Dakota.

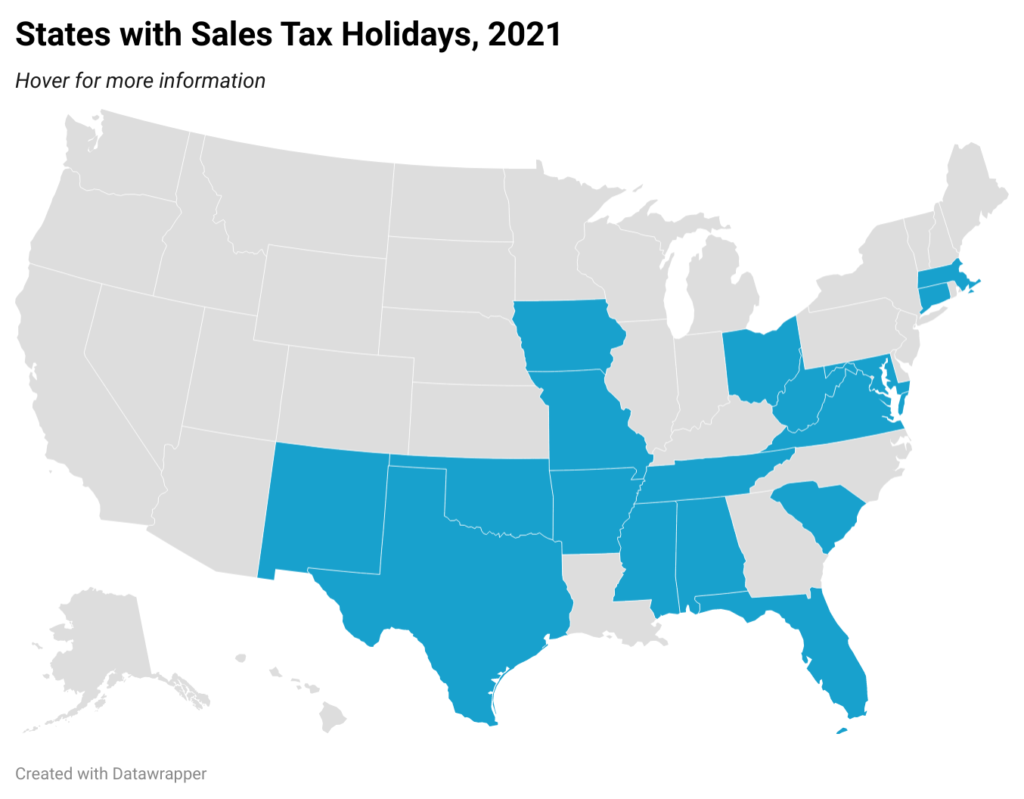

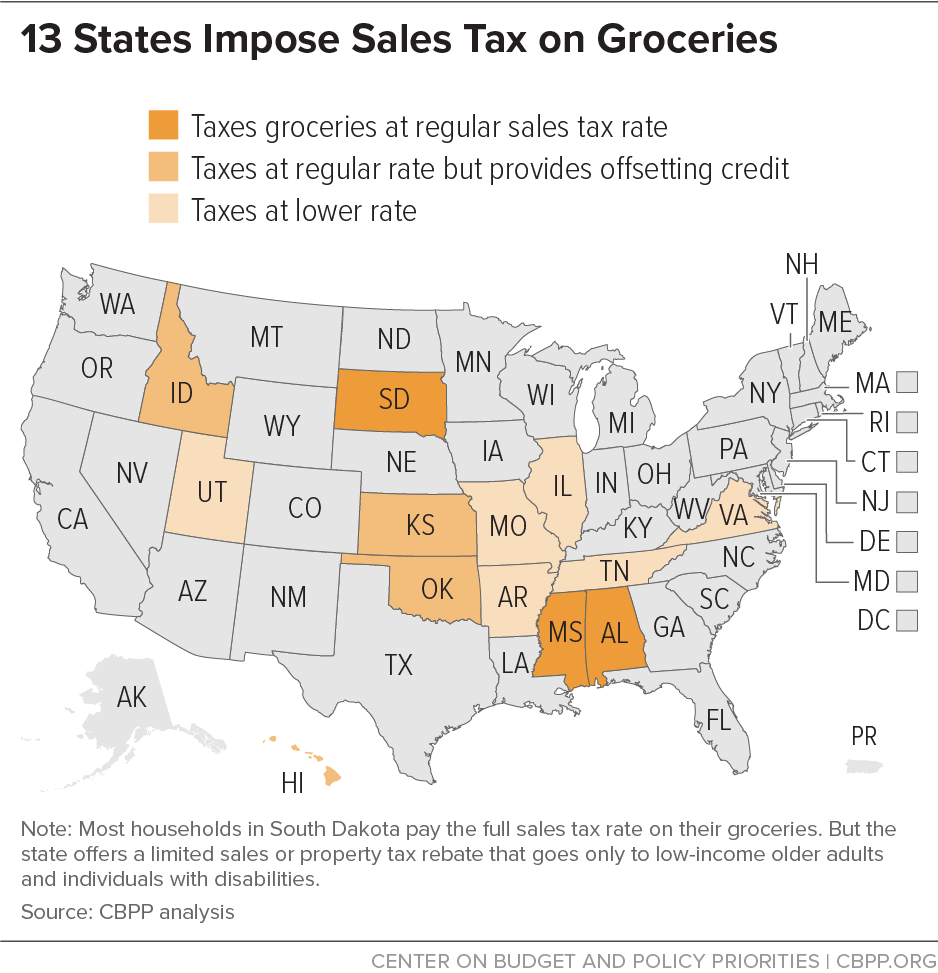

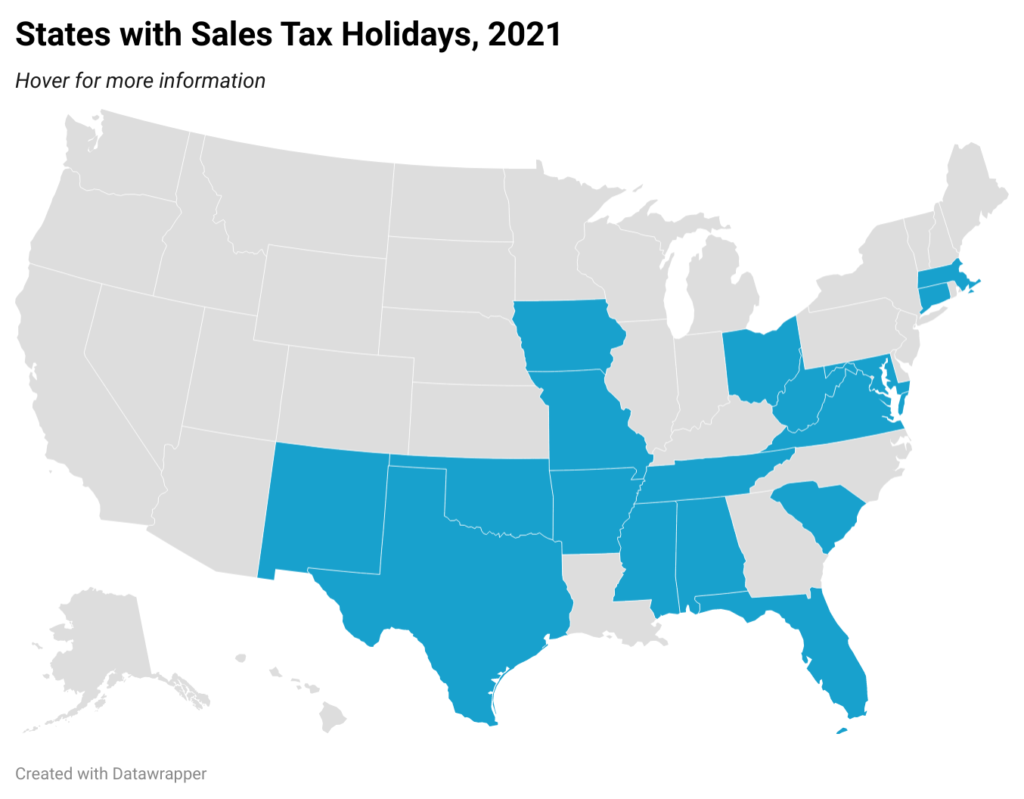

2021 Local Sales Tax Rates The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New York 452 percent and Oklahoma 445 percent. The North Dakota Department of Revenue is responsible for. Tax rates are provided by Avalara and updated monthly.

North Dakota has. Did South Dakota v. With the launch of the new website also comes the release of the 2021 North.

If you need access to a database of all North Dakota local sales tax rates visit the sales tax data page. 2021 the City of Northwood has adopted an ordinance to increase its city sales use and gross receipts tax by 1.

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

North Dakota Sales Tax Rates By City County 2022

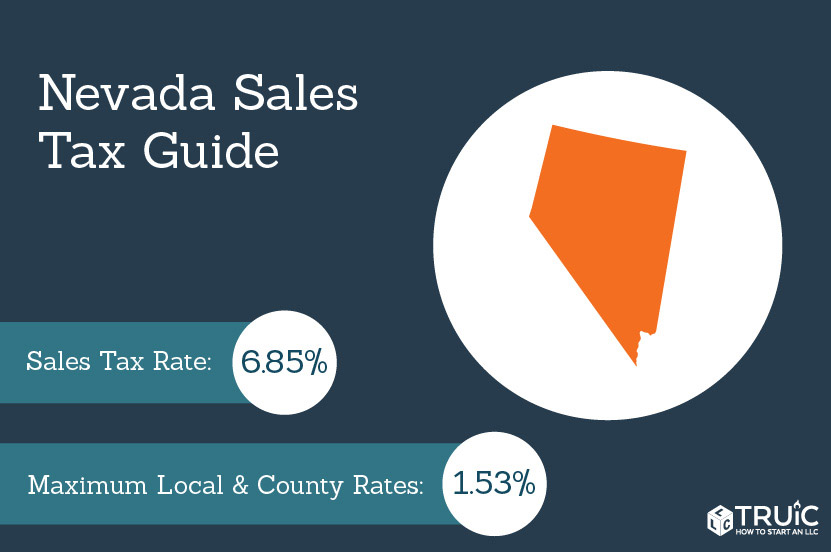

Nevada Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Car Sales Tax In North Dakota Getjerry Com

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

How Do State And Local Individual Income Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

State And Local Sales Taxes In 2012 Tax Foundation

The Most And Least Tax Friendly Us States

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

How Is Tax Liability Calculated Common Tax Questions Answered